Smart Financing. Local Partnership. Limited Time Loan Special.

Serving the greater Philadelphia area and select markets nationwide, this is financing that works the way you do: flexible, adaptable, and built on real relationships.

Bundle any of the following with a business checking account to qualify:

- Owner-Occupied Commercial Real Estate Loan – including a one-time opportunity to lower your rate if market rates fall, giving you added flexibility and peace of mind.

- Equipment Loan

- Working Capital Line of Credit

- SBA 7(a) Single Disbursement Loans

Fill out the form below or call us to learn more about how you can benefit from our Business Advantage Bundle!

Business Advantage Bundle Rate Special

| Loan Type | Annual Percentage Rate |

|---|---|

| Owner Occupied Commercial Real Estate | 6.49% |

| Equipment Loan | 6.99% |

| Working Capital Line of Credit | 6.99% |

| SBA 7(a) Loan | Prime* + 1.75% |

How Does it Work?

1. Qualify for and Secure Your Loan

Connect with your commercial relationship manager to learn more about real estate, equipment, working capital or SBA 7(a) loan options that match your growth plan. All real estate transactions must have a Quaint Oak Abstract title policy.

2. Open a Business Checking Account

Begin your deposit relationship with Quaint Oak Bank in addition to taking advantage of the rate special.

3. Bundle and Save

Get $50 off your first order of checks and one year of Remote Deposit Capture (RDC) for free.

Adaptable for Your Growth Goals

Home Health Care and In-Home Service Businesses

Growing your care business means more than hiring: it means investing in how you operate.

Whether you’re expanding into new territories, adding caregiver management software, or navigating delayed reimbursements, our SBA-backed loans and business checking solutions are built to support your cash flow and help you scale with confidence. From equipment upgrades to digital billing systems, we make it easier to stay compliant and serve more families.

Construction and Skilled Trades

You’ve mastered the craft. Now it’s time to streamline the business.

For HVAC contractors, plumbers, electricians, and other skilled trades, growing a company means investing in more than tools. You need digital estimating software, point-of-sale systems, and mobile workforce solutions that help you compete. We offer financing for equipment, real estate, and technology—plus working capital to help you hire, schedule, and manage jobs without delays.

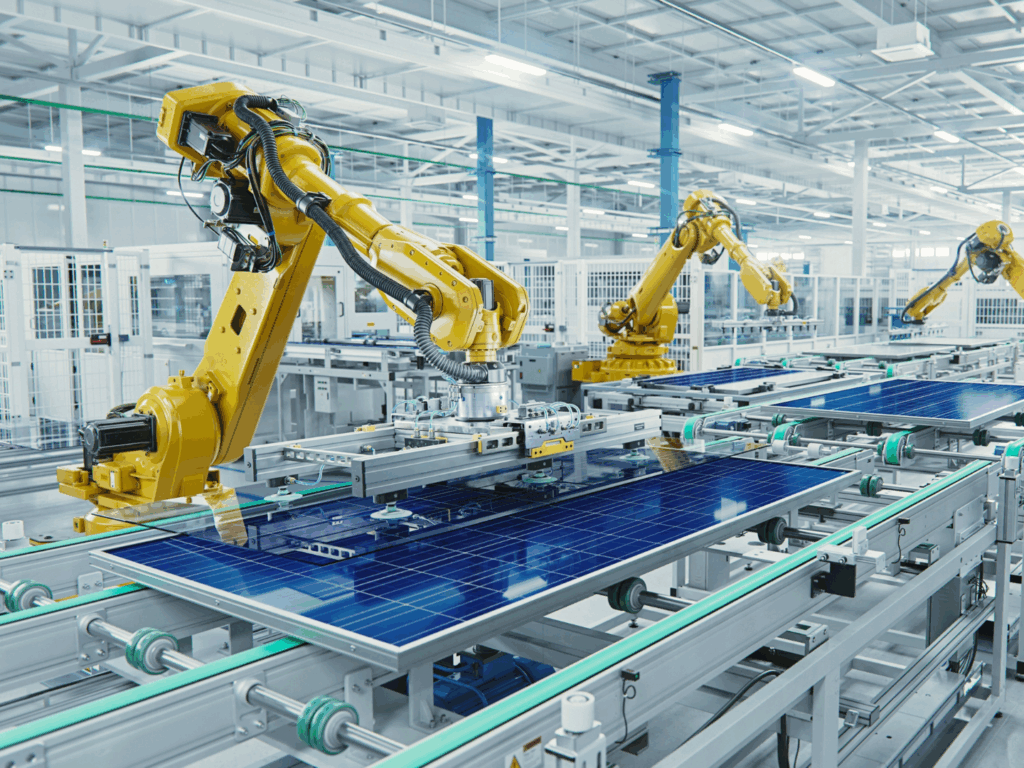

Manufacturing and Specialty Production

Whether you’re fabricating niche parts or managing production, digital precision matters.

Modern manufacturing demands more than machinery. Our lending team understands the investment it takes to implement CAD platforms, inventory software, or automation tools—alongside the real-world equipment and real estate to support it. We’re here to help you grow smarter, faster, and with the financial tools to scale sustainably.

Technology & Innovation Companies

Software is your backbone. Let financing be your advantage.

Whether you’re building custom IT systems, expanding your 3D printing capabilities, or investing in cybersecurity infrastructure, you need financing that understands intangible assets. We fund growth for IT firms, digital service providers, and innovators with specialized needs—helping you manage expenses, optimize billing, and stay ahead of your market.

Business Acquisition Financing

Looking to buy an existing business or expand through acquisition?

We specialize in SBA 7(a) loans that support business transitions—whether you’re acquiring a home health agency, a niche manufacturer, or a specialty contractor. Our relationship-focused approach means you get a partner who understands valuation, deal structure, and post-acquisition cash flow.

You Deserve More Than a Bank: You Deserve a Partner Who’s Invested in Your Future

What could your business achieve with the right partner in your corner? When you pair our commercial lending options with personalized business banking services, you gain more than capital—you gain a relationship built on understanding, trust, and long-term support.

We help you:

- Secure or renovate your workspace, whether that’s a clinic, warehouse, service hub, or other crucial business space.

- Purchase equipment and software to streamline operations and stay competitive

- Manage cash flow to build stability.

- Expand locations, acquire businesses, or grow your team when opportunity calls

We’ve partnered with many industries, including:

- Home health care providers adding new services and staff

- Skilled trades businesses investing in both digital and physical tools

- Manufacturers and refurbishers scaling production with smarter systems

- Technology-forward organizations integrating CAD, POS, and automation

Why Local Business Owners Choose Quaint Oak

Personalized Lending Experience: No call centers. Just real people who know your name.

Preferred SBA Lender: Fast, flexible SBA loan options designed around your goals—not someone else’s formula.

Deep Local Knowledge: Smart strategies and responsive service rooted in our community.

Step-by-Step Support: We walk with you from application to closing and beyond.

Let’s build what’s next—together.

1Limited time offer available for commercial customers only. All loans subject to credit approval. Terms and conditions apply. Applications must be received by September 30, 2025, and loans must close by November 30, 2025, or prior to funds running out, whichever occurs first. The annual percentage rate (APR) available will be based on the Wall Street Journal Prime** Rate at the time of closing (7.00% as of October 31, 2025). $10 million in promotional funding has been allocated to this program. Repricing of existing approved-but-not-yet-closed loans may be considered upon borrower request (not applicable to SBA 7(a) loans). A Quaint Oak Abstract Title policy is required for all real estate–secured transactions. Offer not available for refinancing existing Quaint Oak Bank loans or for startup businesses, hospitality, landscaping, construction, or restaurant-related projects.