Medical and Professional Practice Equipment Financing Options for Growing Your Practice

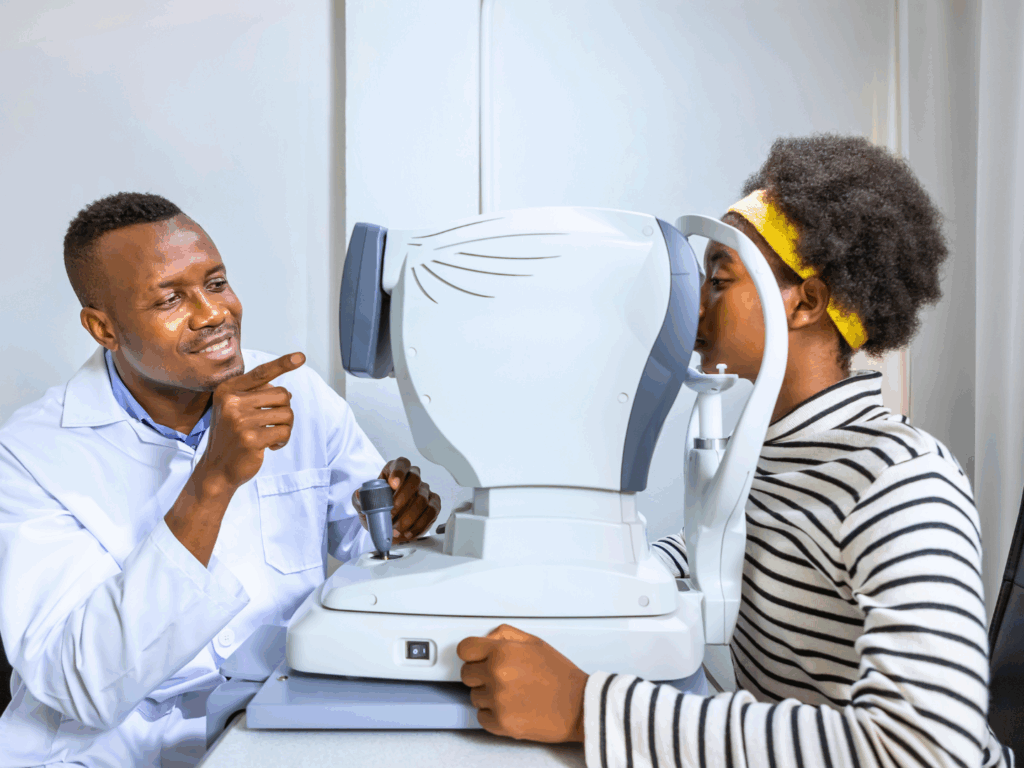

Running your own healthcare or professional practice means balancing compassionate care with smart financial decisions. Whether you’re a home healthcare agency adding vehicles for your caregiver team, a physical therapist upgrading treatment tables, a dentist investing in digital imaging, or an eye doctor installing the latest diagnostic equipment—your investments should support both your mission and your bottom line.

Paying for equipment all at once can strain cash flow—especially when you’re also managing payroll, rent or mortgage obligations, and day-to-day operational costs. A financing plan tailored to your practice’s needs allows you to spread costs over time, so your new equipment can start generating revenue right away.

Just like your practice is rooted in care, your financial plan should be rooted in sustainability. In this blog, we’ll walk through the most common medical and professional practice equipment financing options, when each makes sense, and how to choose a commercial loan path that fits your growth plan.

SBA 7(a): Flexible Funding for Medical Practice Growth

If you’re looking for one loan that covers more than just equipment, the SBA 7(a) Loan offers flexibility and long-term value.

- Why it works: Competitive interest rates, lower down payments, and repayment term ranges depending on the purpose of the loan.

- Best for: Practices that want to bundle equipment financing with other needs—such as remodeling treatment rooms, hiring additional staff, or covering startup costs for a new location.

- Example: A physical therapy practice buying new rehab machines and expanding into the vacant suite next door could use one 7(a) loan to fund both.

Think of it as a flexible foundation, supporting both your immediate needs and your vision for growth. As an SBA Preferred Lender (PLP), Quaint Oak Bank can process and approve qualifying applications faster, keeping your plans on track and your project moving forward.

SBA 504: Long-Term Financing for Big-Ticket Purchases

When your investment centers on big-ticket purchases that support your practice’s future, like advanced equipment or your own building, the SBA 504 program is worth considering.

- Why it works: Longer repayment terms (up to 25 years) and partially fixed interest rates help align payments with the useful life of your asset.

- Best for: Practices making substantial, long-term investments—such as dental imaging systems, ophthalmology diagnostic suites, or specialized therapy equipment.

- Example: An eye care clinic purchasing advanced OCT scanners and buying the building it operates in could use a 504 loan to finance both under one structured plan.

We’ll work with you to structure a plan that fits your timeline, budget, and long-term goals so your investment becomes a lasting part of your practice’s foundation.

Business Term Loans: Fast, Predictable Funding for Essential Equipment

If your practice has strong financials and you’re looking for a straightforward solution, a business term loan can offer quick access to funds—without the added paperwork of SBA programs.

- Why it works: Lump-sum funding with fixed repayment terms—typically three to seven years for equipment—so you can plan your payments with confidence.

- Best for: Replacing or upgrading one or two pieces of essential equipment quickly, without disrupting your cash flow.

- Example: A dental practice replacing an aging panoramic X-ray machine could use a term loan to have it installed in weeks rather than months—keeping patient care uninterrupted.

This option is ideal when speed and simplicity matter, and when your financial foundation is already strong.

Equipment Loans: Purpose-Built Financing for Growing Practices

When you’re investing in essential tools for your practice, the equipment itself can often serve as collateral. That means fewer additional guarantees, faster approvals, and a financing process that’s built around your needs.

With an equipment loan, you gain ownership of your purchase, experience predictable monthly payments, and may benefit from potential tax advantages. Terms are typically aligned with the useful life of the asset, so your payments stay in step with your cash flow.

Best for businesses like:

- Home healthcare agencies adding fleet vehicles for caregiver transportation

- Physical therapists purchasing rehabilitation or diagnostic equipment that evolves rapidly

- Dental, optical, and specialty practices acquiring advanced technology to enhance patient care without tying up significant capital

Example: A dental practice financing a new digital panoramic X-ray machine can own the asset outright while spreading the cost over several years—keeping monthly expenses manageable and preserving working capital for other needs.

Whether you’re upgrading a single piece of equipment or outfitting an entire treatment room, equipment loans offer a practical path forward, so you can focus on care, not cash flow.

Working Capital Lines of Credit: Keep Your Practice Running Smoothly

Major equipment purchases often come with ripple effects like onboarding new staff, launching marketing for new services, or stocking up on supplies. A business line of credit can work alongside your primary loan to keep operations steady while you grow.

For practices that rely on insurance reimbursements, a line of credit can also help bridge the gap by covering payroll and expenses while you wait for payments to clear. It’s a flexible safety net that supports your day-to-day needs without tying up long-term capital.

Which Financing Option Fits Your Practice?

Every practice is unique—and so is the right financing strategy. Here’s a quick guide to help you match your goals with the right solution:

| Practice Goal | Best Financing Option | Why It Works |

|---|---|---|

| Need one critical device right away | Conventional Term Loan | Fast, predictable funding for immediate, one-time equipment purchases |

| Upgrade equipment and remodel space | SBA 7(a) Loan | Offers flexibility to fund a variety of business improvements |

| Buy high-value assets or real estate | SBA 504 Loan | Designed for long-term investments with favorable rates and terms |

| Stay ahead in fast-changing tech | Equipment Leasing | Enables regular updates to stay current without heavy upfront costs |

| Smooth out seasonal cash flow or uneven reimbursements | Working Capital Line of Credit | Provides financial flexibility to manage short-term cash flow fluctuations |

What Will Lenders Review for Health Professionals?

When you apply for equipment financing, lenders look beyond the numbers. They consider the full picture of your practice. Here’s what they may evaluate:

- Cash flow: Can your practice comfortably support the monthly payment?

- Down payment & reserves: SBA loans may require less upfront, but having liquidity still matters.

- Time in business & specialty: Established revenue patterns help, but strong projections and professional experience can support startup approval.

- Collateral & guarantors: Requirements vary by program and your banker will help structure the best option for your situation.

Why Healthcare and Professional Practices Choose Quaint Oak Bank

Your practice isn’t just a business: it’s a commitment to care, a team you’ve built, and a reputation you’re growing in the community you serve. At Quaint Oak Bank, we understand that your financial decisions should support all of that.

That’s why we offer:

- Partnership banking relationships

We take time to understand your full operation—not just your loan request—so we can tailor solutions that fit your goals. - Local decision-making

You’ll get faster answers from people who know your market and respect the work you do. - Tailored solutions

We help you compare SBA 7(a), SBA 504, conventional loans, equipment loans, and leasing options side by side—so you can choose what’s right for your practice. - SBA Preferred Lender (PLP) status

Our streamlined process means faster approvals on qualifying SBA loans, so you can move forward with confidence.

Equipment Financing Options for Growing Your Practice: Let’s Build What’s Next, Together

Whether you’re expanding your clinic, upgrading technology, or preparing for future growth, the right financing can make all the difference. Connect with a Commercial Relationship Manager today to talk through your plans and explore medical and professional practice equipment financing options that support your mission and your momentum.

Contact Us Today!

All Loans Subject to Approval

1 All case studies are for illustration purposes only and do not represent actual customers or specific business outcomes. They are hypothetical examples intended to demonstrate how SBA loans can be utilized by different types of businesses. Individual results may vary based on factors such as business size, industry, and loan terms.