Dental Practice Finance 101: Using SBA 7(a) Loans for Equipment Upgrades

Are you trying to purchase equipment for your dental practice, but unsure about the best financing options? SBA loans for dentists are a game-changing resource that can help you make critical upgrades without putting your practice at financial risk. From digital imaging to in-house lab systems, modern dental tools are essential to remain competitive—and affordable financing is key.

That’s why many dental practices turn to SBA loans for dentists, leveraging their low interest rates and flexible terms to invest in the future. Below, we’ll break down how SBA 7(a) loans work and why they are such a strategic solution for practice growth.

What Is an SBA 7(a) Loan?

The SBA 7(a) loan is the most popular product offered by the U.S. Small Business Administration. These loans are issued by private lenders but partially guaranteed by the SBA, which reduces risk and opens doors for small business owners—including dental professionals. With the right guidance, SBA loans for dentists can offer a long-term, low-cost way to finance critical upgrades.

Why SBA Loans Work for Dentists

The SBA 7(a) loan program is a government-backed option designed for small business owners. It offers many benefits that align with the needs of healthcare providers like you, such as:

- Lower down payments to help preserve your working capital

- Longer repayment terms (often up to 10 years for equipment financing)

- Competitive interest rates to keep borrowing affordable

- Flexible uses—you can fund equipment, renovations, working capital, and more

This loan structure allows you to grow without draining savings or maxing out business credit cards.

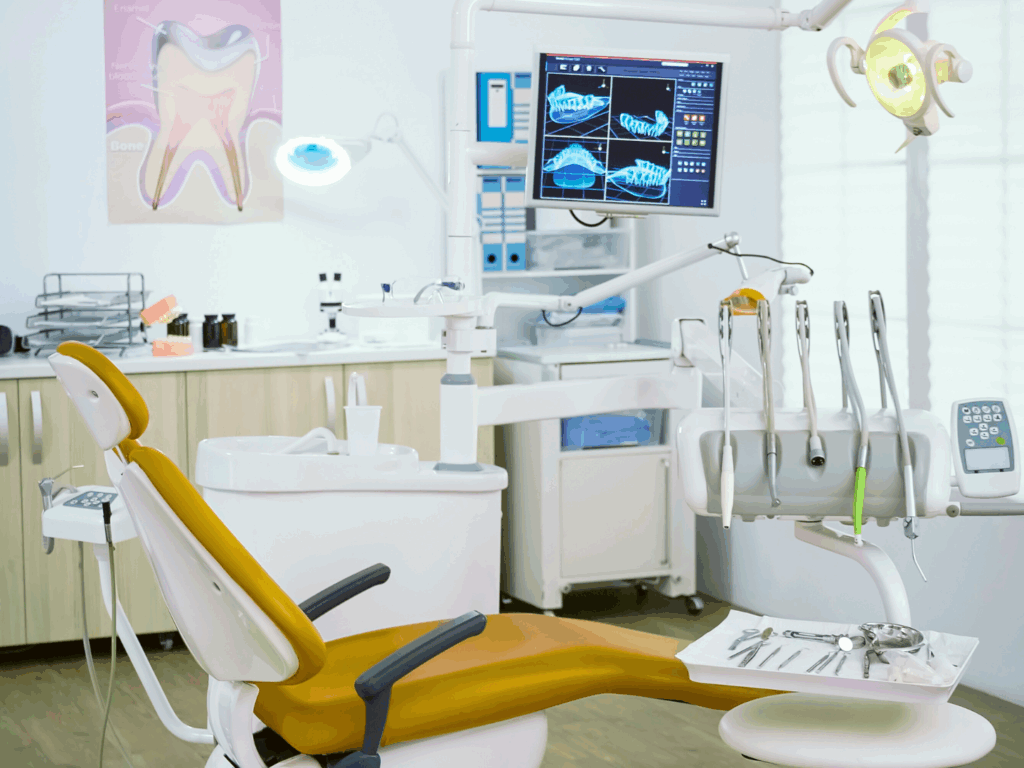

What Dental Equipment Can Be Financed?

An SBA loan could cover a broad range of dental tools and technology, purchases that could be used to enhance patient care, increase efficiency, or support your staff. This could include:

- 3D imaging and panoramic X-ray machines

- Chairs, stools, and delivery systems

- In-house lab and diagnostic tools

- Practice management software, billing systems, and IT upgrades

- Waiting room and office furniture or upgrades

If it helps your practice serve patients better or operate more smoothly, your commercial relationship manager can help you determine if it meets SBA loan guidelines.

How One Philadelphia Dentist Upgraded Her Practice with an SBA 7(a) Loan

A dentist1 in the heart of Philadelphia decided after a decade in practice, that it was time to modernize his office. Outdated imaging systems and legacy software were slowing him down—and patients noticed.

Rather than depleting his savings, he explored SBA loans for dentists and found an ideal solution through a Preferred SBA Lender to finance an equipment upgrade through the SBA 7(a) loan program. With longer repayment terms and competitive rates, he was able to invest in a new 360° X-ray unit, advanced diagnostic tools, and updated patient management software, all without disrupting his cash flow.

How to Get Started with an SBA Loan

Preferred Lenders like Quaint Oak Bank have authority to make lending decisions on behalf of the SBA. Use the steps below to help streamline the process.

Gather Your Documents

- Business tax returns

- Practice financial statements

- Equipment quotes

- Business plan or projection models

Work With a Preferred SBA Lender

This streamlines the process. Preferred Lenders like Quaint Oak Bank have authority to make lending decisions on behalf of the SBA.

Structure a Strong Application

With expert guidance, you’ll submit an application that aligns with your goals and demonstrates repayment ability.

Get Approved and Purchase Your Equipment

Once approved, funds are disbursed and your equipment upgrade can begin.

You can learn more about the SBA application process by reading, “Starting Your SBA 7(a) Application: What You Need to Know.“

Why Work with a Specialized Lender for Dental SBA Loans?

SBA loans are powerful tools, but to truly get the most out of your experience it is important to partner with an expert in the field.

At Quaint Oak Bank, we work closely with dental professionals to simplify financing and build long-term partnerships. We understand how complex it can be for you to navigate the flow of private practices, the complexity of managing patient volume, and the importance of staying ahead in a competitive field.

As an SBA Preferred Lender, we offer faster turnaround times, personalized guidance, and financing strategies that align with your growth goals, not just your numbers on paper.

You’re not just another business to us. You’re part of the community we serve.

SBA Loans for Dentists: Upgrade with Confidence

You shouldn’t have to delay growth because of cost. With the right SBA loan for dentists, you can upgrade your equipment, improve patient experience, and build a future-ready practice—all without draining your cash reserves.

Let’s talk about what’s next for your dental practice. Quaint Oak Bank is here to help you take the next step—confidently, and with expert guidance.

Contact Us Today!

All Loans Subject to Approval

1 All case studies are for illustration purposes only and do not represent actual customers or specific business outcomes. They are hypothetical examples intended to demonstrate how SBA loans can be utilized by different types of businesses. Individual results may vary based on factors such as business size, industry, and loan terms.